AI-Powered Freelancer Payout Crew

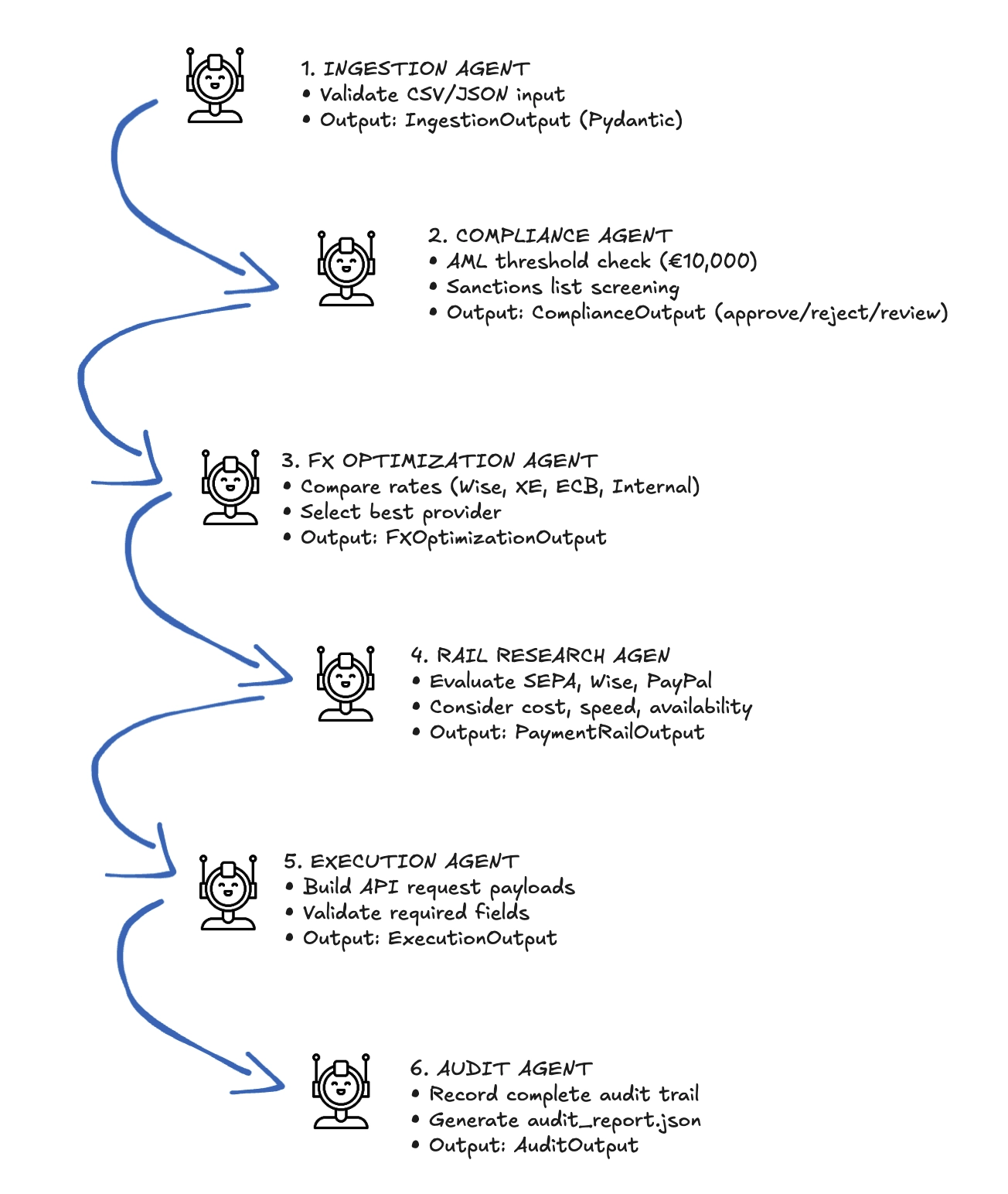

This Freelancer Payout Crew implemented using CrewAI, is a multi-agent AI system that automates the complete lifecycle of freelancer payments while aiming for regulatory compliance. It processes payout requests through six specialized agents, each responsible for a specific aspect of the payment flow.

The Business Challenge

Managing payments for a global freelance workforce is a complex, manual, and time-consuming operation. Finance teams are burdened with:

Compliance Risks: Manually screening for Anti-Money Laundering (AML) regulations and international sanctions is error-prone.

Operational Inefficiency: Processing payouts involves multiple steps: data validation, FX conversion, payment method selection, and execution.

High Costs: Suboptimal currency exchange and payment method selection eat into margins.

Audit Headaches: Creating a clear, defensible audit trail for regulators is a time-consuming manual process.

Technical Architecture at a Glance

This automation system is built with CrewAI and orchestrates a sequential workflow where each specialist agent hands off its work to the next. All data is validated with type-safe pydantic BaseModel models, ensuring reliability and output consistency. It was built with a modular design in mind so that new payment methods or compliance rules can be added without disrupting the core system.

Meet the CrewAI Team:

The Data Validator: Ingests and cleans possibly messy payout data, ensuring it meets strict standards before anything is processed.

The Compliance Officer: Automatically screens every payment against AML rules (e.g., blocking payments over €10,000) and international sanctions lists, providing a clear “approve” or “reject” decision with reasons.

The FX Optimizer: For cross-border payments, this agent is looking for the best available exchange rates, ensuring freelancers get more of their money and the company saves on fees.

The Route Planner: Intelligently selects the best payment method (SEPA, Wise, or PayPal) based on cost, speed, and the freelancer’s location and banking details.

The Executor: Safely prepares the payment instructions for the chosen method, with built-in checks to prevent errors.

The Auditor: Meticulously records every action, decision, and reason, generating a complete audit trail that is ready for regulatory review.

Key Business Value & Features

- Expected large reduction in manual effort: The entire process, from data ingestion to payment execution, is fully automated.

- Build with compliance in mind: Built-in checks for AML, sanctions, and data protection (GDPR) to reduce regulatory risk.

- Cost Optimization: Automated FX rate comparison and smart payment rail selection to find the best option for lower transaction costs.

- Full Auditability: Every decision is logged with a “who, what, when, and why,” making compliance reporting simple and fast.

- Future-Proof & Extensible: The system is built to easily incorporate new payment providers, compliance rules, and even support emerging standards like Google’s Agent Payment Protocol (AP2) for interoperability with other AI financial systems.

Summary of System Value

| Aspect | Feature | Business Value |

|---|---|---|

| Compliance | AML/Sanctions/GDPR checks, €10,000 EDD threshold, full audit log | Mitigates regulatory risk, ensures adherence to international finance law. |

| Efficiency | FX Optimization, smart Payment Rail Selection | Reduces transaction costs, improves payment speed, and optimizes foreign exchange exposure. |

| Operations | Multi-agent automation, Pydantic type safety, AP2 integration | Increases processing throughput, minimizes manual oversight, and ensures system reliability. |